What Does Health Insurance In Toccoa Ga Mean?

Table of ContentsThe Ultimate Guide To Automobile Insurance In Toccoa Ga9 Easy Facts About Life Insurance In Toccoa Ga ExplainedThe smart Trick of Affordable Care Act Aca In Toccoa Ga That Nobody is Talking AboutAll about Affordable Care Act Aca In Toccoa Ga

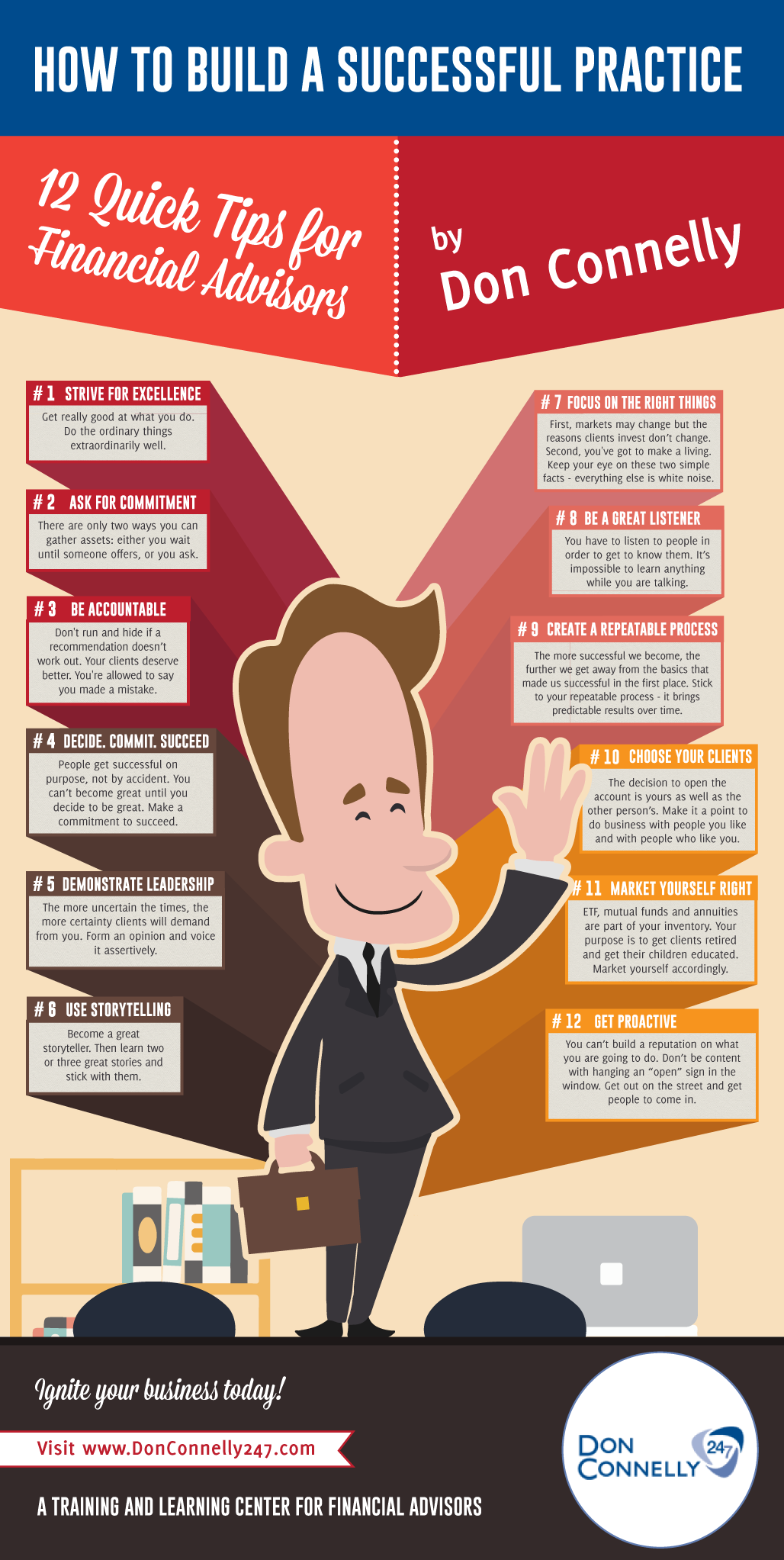

An economic advisor can additionally aid you determine just how finest to accomplish goals like saving for your child's university education and learning or paying off your debt. Financial advisors are not as fluent in tax obligation legislation as an accountant could be, they can use some support in the tax planning procedure.Some financial consultants offer estate preparation services to their clients. It's vital for monetary experts to stay up to date with the market, financial conditions and consultatory ideal methods.

To market investment products, experts must pass the appropriate Financial Sector Regulatory Authority-administered examinations such as the SIE or Collection 6 exams to obtain their accreditation. Advisors that desire to sell annuities or various other insurance products should have a state insurance policy license in the state in which they prepare to offer them.

What Does Health Insurance In Toccoa Ga Mean?

Let's say you have $5 million in assets to take care of. You hire a consultant that charges you 0. 50% of AUM per year to help you. This means that the consultant will get $25,000 a year in costs for managing your financial investments. As a result of the normal fee structure, several consultants will certainly not work with clients that have under $1 million in assets to be handled.

Investors with smaller profiles could look for a financial consultant that bills a per hour fee rather than a portion of AUM. Hourly charges for consultants typically run between $200 and $400 an hour. The more complicated your monetary scenario is, the more time your expert will have to dedicate to managing your assets, making it much more costly.

Advisors are knowledgeable professionals who can help you develop a prepare for financial success and execute it. You may likewise think about connecting to an expert if your individual monetary scenarios have actually just recently ended up being a lot more challenging. This can suggest acquiring a residence, marrying, having kids or receiving a large inheritance.

About Medicare Medicaid In Toccoa Ga

Prior to you meet the advisor for an initial assessment, consider what solutions are essential to you. Older grownups might need help with retirement planning, while younger adults (Annuities in Toccoa, GA) might be seeking the very best means to spend an inheritance or beginning an organization. You'll desire to seek a consultant who has experience with the services you want.

For how long have you been suggesting? What organization were you in prior to you got right into economic encouraging? Who composes your normal client base? Can you provide me with names of several of your customers so I can discuss your solutions with them? Will I be dealing with you directly or with an associate expert? You may also intend to take a look at some sample economic plans from the expert.

If all the examples you're provided are the very same or similar, it might be an indicator that this expert does not appropriately customize their recommendations for every customer. There are 3 primary sorts of financial suggesting experts: Qualified Monetary Coordinator professionals, Chartered Financial Analysts and Personal Financial Specialists - https://www.40billion.com/profile/1050144873. The Certified Financial Organizer specialist (CFP professional) certification suggests that a consultant has actually fulfilled a specialist and ethical standard set by the CFP Board

The Best Guide To Insurance In Toccoa Ga

When picking a monetary consultant, consider somebody with a specialist credential like a CFP or CFA - https://lwccareers.lindsey.edu/profiles/3840718-jim-thomas. You could likewise consider a consultant who has experience in the services that are essential to you

These advisors are usually filled with problems of rate of interest they're much more salespeople than experts. That's why it's essential that you have an expert who works just in your finest rate of interest. If you're looking for an advisor that can really provide actual value to you, it is essential to research a variety of potential alternatives, not just pick the initial name that promotes to you.

Currently, several consultants need to act in your "finest interest," yet what that entails can be virtually unenforceable, other than in the most outright cases. You'll require to find an actual fiduciary. "The first examination for a good economic advisor is if they are benefiting you, as your advocate," says Ed Slott, CPA and owner of "That's what a fiduciary is, however every person states that, so you'll require other indicators than the expert's say-so and even their qualifications." Slott suggests that customers look to see whether consultants purchase their ongoing education and learning around tax planning for retired life savings such as 401(k) and IRA accounts.

"They must confirm it to you by showing they have taken major continuous training in retired life tax obligation and estate preparation," he claims. "You should not invest with any kind of expert that does not spend in their education and learning.